The transition to a low-carbon global economy relies heavily on a stable supply of critical minerals—such as lithium, cobalt, nickel, and graphite—that are essential to renewable energy systems, electric vehicle batteries, and energy storage technologies. Despite recent volatility in critical mineral markets, with prices dropping significantly in 2023 after years of sharp increases, demand has held steady, driven by the ongoing deployment of clean energy solutions. This price fluctuation has largely been due to an increase in supply and high inventories rather than a decrease in demand. As the demand for clean technologies grows, securing reliable, sustainable sources of these minerals becomes increasingly important.

The rising demand for critical minerals brings two significant risks that could hinder the global shift to a low-carbon economy. First, the high concentration of mineral supply among a few major producers increases the vulnerability of global markets to potential disruptions. The second risk lies in the drive to expand mineral extraction at the expense of environmental and social safeguards.

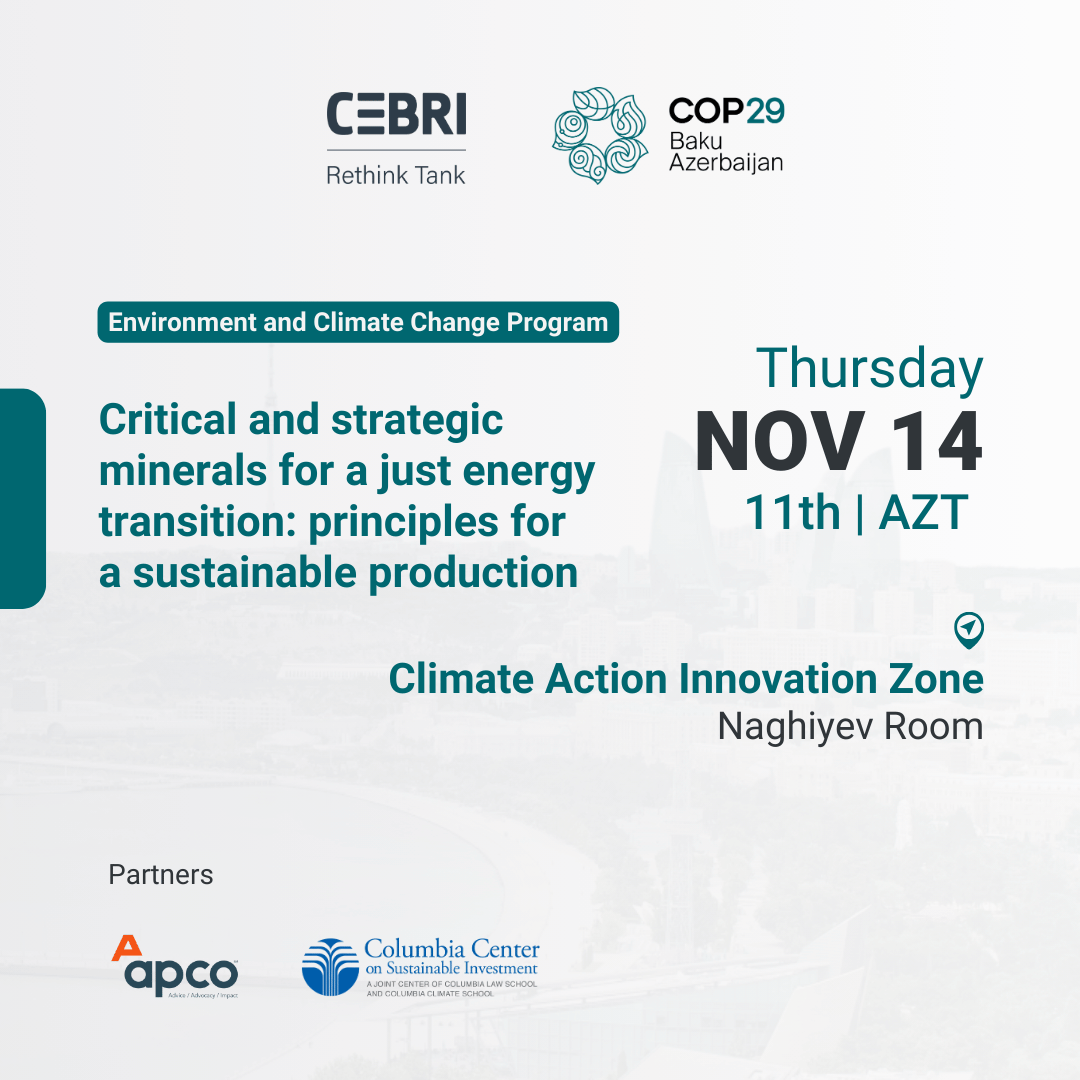

The panel seeks to drive a transformative conversation on advancing sustainable financing mechanisms that not only attract investment but also uphold social and environmental integrity. By championing frameworks that align economic growth with human rights, environmental preservation, and long-term prosperity, this discussion aims to inspire countries to adopt impactful financing models that pave the way for a resilient, responsible global economy.

SPEAKERS

- Izabella Teixeira, Conselheira Emérita do CEBRI, ex-Ministra do Meio Ambiente (2010-2016) e Co-Chair do Painel Internacional de Recursos Naturais da ONU Meio Ambiente;

- Nicole Monge, APCO Director and COP Lead;

- Rafaela Guedes, Senior Fellow at CEBRI;

- Alexandre Mello, Director of Associative Affairs and Climate Change at the Brazilian Mining Association (IBRAM);

- Kirsten Hund, GM Climate and Nature at Vale Base Metals;

- Shuva Raha, Fellow and Lead - International Cooperation, Council on Energy, Environment and Water (CEEW), India;

- Chinmayi Shalya, Senior Fellow, Global Climate and Development Institute (GCDI), Swaniti Global, India;

- Alex Benkenstein, Head of Climate and Natural Resources Programme at the South African Institute of International Affairs (SAIIA);

- Kerry Constabile, Director for Decarbonization Strategy at Amazon;

- Julia Paletta, Energy and Climate Change Specialist at CEBRI

The transition to a low-carbon global economy relies heavily on a stable supply of critical minerals—such as lithium, cobalt, nickel, and graphite—that are essential to renewable energy systems, electric vehicle batteries, and energy storage technologies. Despite recent volatility in critical mineral markets, with prices dropping significantly in 2023 after years of sharp increases, demand has held steady, driven by the ongoing deployment of clean energy solutions. This price fluctuation has largely been due to an increase in supply and high inventories rather than a decrease in demand. As the demand for clean technologies grows, securing reliable, sustainable sources of these minerals becomes increasingly important.

The rising demand for critical minerals brings two significant risks that could hinder the global shift to a low-carbon economy. First, the high concentration of mineral supply among a few major producers increases the vulnerability of global markets to potential disruptions. The second risk lies in the drive to expand mineral extraction at the expense of environmental and social safeguards.

The panel seeks to drive a transformative conversation on advancing sustainable financing mechanisms that not only attract investment but also uphold social and environmental integrity. By championing frameworks that align economic growth with human rights, environmental preservation, and long-term prosperity, this discussion aims to inspire countries to adopt impactful financing models that pave the way for a resilient, responsible global economy.

SPEAKERS

- Izabella Teixeira, Conselheira Emérita do CEBRI, ex-Ministra do Meio Ambiente (2010-2016) e Co-Chair do Painel Internacional de Recursos Naturais da ONU Meio Ambiente;

- Nicole Monge, APCO Director and COP Lead;

- Rafaela Guedes, Senior Fellow at CEBRI;

- Alexandre Mello, Director of Associative Affairs and Climate Change at the Brazilian Mining Association (IBRAM);

- Kirsten Hund, GM Climate and Nature at Vale Base Metals;

- Shuva Raha, Fellow and Lead - International Cooperation, Council on Energy, Environment and Water (CEEW), India;

- Chinmayi Shalya, Senior Fellow, Global Climate and Development Institute (GCDI), Swaniti Global, India;

- Alex Benkenstein, Head of Climate and Natural Resources Programme at the South African Institute of International Affairs (SAIIA);

- Kerry Constabile, Director for Decarbonization Strategy at Amazon;

- Julia Paletta, Energy and Climate Change Specialist at CEBRI