Reports

Overview of Investments in Infrastructure and Transport in Brazil

- 08 december 2025

Originating from the EU–Brazil Investment Dialogue project (organized by CEBRI, ApexBrasil, and EUDEL), this factsheet provides a critical assessment of Brazil’s infrastructure pipeline and its implications for European investors and for the decarbonization agenda.

Its main findings include:

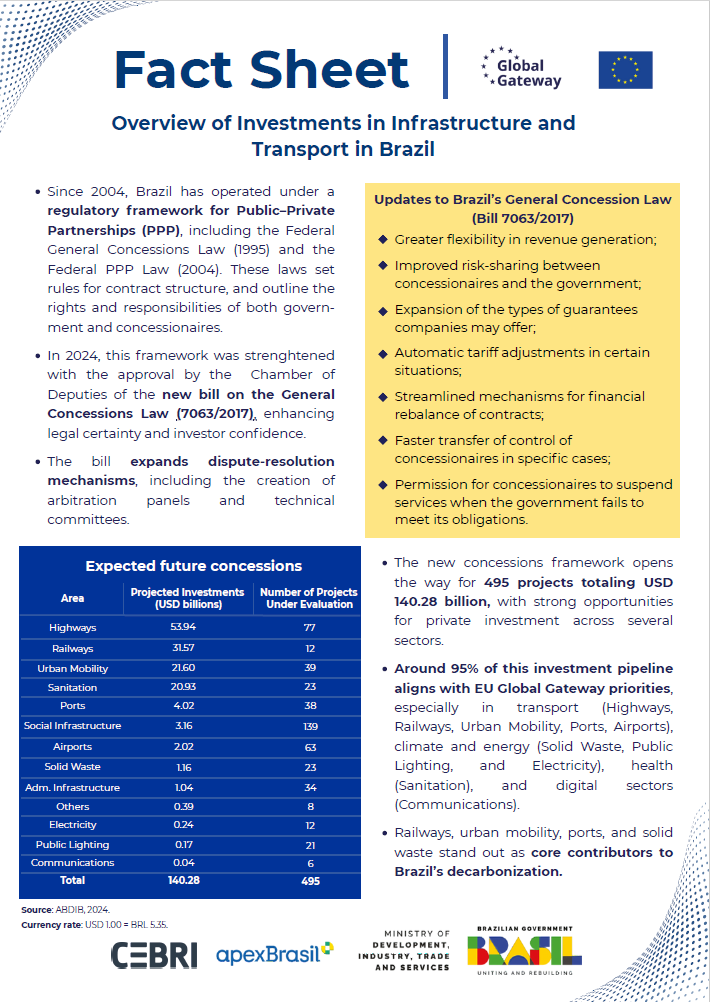

- The ability of the new Concessions Law framework (Bill 7063/2017) to strengthen legal certainty by expanding dispute-resolution mechanisms, increasing revenue-generation flexibility, and allowing a broader range of guarantees — changes that may reduce risk premiums and attract more sophisticated private capital.

- With 495 projects under evaluation and an estimated volume of roughly USD 140.3 billion, the most significant opportunities for investors lie in transport modalities (highways, railways, urban mobility) and in climate-related sectors such as solid waste and public lighting; these segments also align with the EU’s Global Gateway Strategy, creating room for cross-border public-private partnerships.

- The financial analysis highlights a structural gap: infrastructure investment represents about 2.2% of GDP and must nearly double to meet demand, pointing to opportunities for multilateral co-financing and risk-mitigation instruments (guarantees, blended finance).

- From a climate perspective, the factsheet draws on data from Phase 2 of the Energy Transition Program (PTE2), led by CEBRI in partnership with institutions such as BNDES and the IDB. The findings indicate that shifting freight transport toward railways and waterways, as well as promoting urban e-mobility, are key measures for reducing emissions in the transport sector; this creates a market for European technologies in rail systems, charging infrastructure, and logistics-efficiency solutions.

In summary, the factsheet offers practical recommendations — accelerating export corridors, improving risk structuring, and deploying blended financial instruments — that position Brazil as a promising environment for European investors seeking climate impact and long-term structural returns.

Originating from the EU–Brazil Investment Dialogue project (organized by CEBRI, ApexBrasil, and EUDEL), this factsheet provides a critical assessment of Brazil’s infrastructure pipeline and its implications for European investors and for the decarbonization agenda.

Its main findings include:

- The ability of the new Concessions Law framework (Bill 7063/2017) to strengthen legal certainty by expanding dispute-resolution mechanisms, increasing revenue-generation flexibility, and allowing a broader range of guarantees — changes that may reduce risk premiums and attract more sophisticated private capital.

- With 495 projects under evaluation and an estimated volume of roughly USD 140.3 billion, the most significant opportunities for investors lie in transport modalities (highways, railways, urban mobility) and in climate-related sectors such as solid waste and public lighting; these segments also align with the EU’s Global Gateway Strategy, creating room for cross-border public-private partnerships.

- The financial analysis highlights a structural gap: infrastructure investment represents about 2.2% of GDP and must nearly double to meet demand, pointing to opportunities for multilateral co-financing and risk-mitigation instruments (guarantees, blended finance).

- From a climate perspective, the factsheet draws on data from Phase 2 of the Energy Transition Program (PTE2), led by CEBRI in partnership with institutions such as BNDES and the IDB. The findings indicate that shifting freight transport toward railways and waterways, as well as promoting urban e-mobility, are key measures for reducing emissions in the transport sector; this creates a market for European technologies in rail systems, charging infrastructure, and logistics-efficiency solutions.

In summary, the factsheet offers practical recommendations — accelerating export corridors, improving risk structuring, and deploying blended financial instruments — that position Brazil as a promising environment for European investors seeking climate impact and long-term structural returns.